Why should Personal Asset advisors manage my money?

Most do-it-yourself investors make mistakes that cost them a lot of money over time. And many who call themselves “advisors” are actually conflicted brokers incentivized to sell you high-fee products. Some have good intentions, but still use mutual funds inefficiently.

As the modern way to manage your net worth, Personal Asset combines award-winning technology and financial tools with experienced people to create the smart, easy way to transform your financial future. Our advisors are fiduciaries with decades of combined experience managing money for high-net-worth and institutional clients, and they possess a strong desire to drive change and improve the industry.

Personal Asset is the smart way to get a real-time grasp of your finances. Independent and set up to avoid conflicts of interest, we've developed a simple way to invest better that delivers maximum diversification, a smart index approach, low fees, tax management, disciplined rebalancing and full transparency.

What is your investment philosophy?

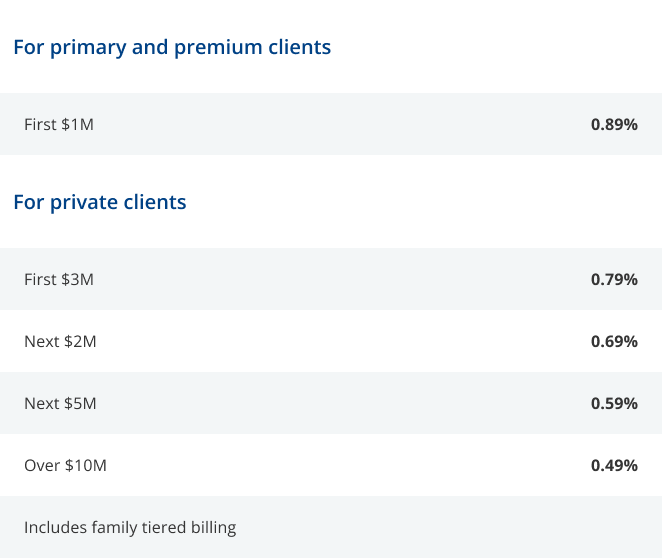

We believe in the power of technology to change the financial industry, making it more accessible, affordable and honest. We believe in the power of people to change the nature of investment advice, making it more transparent, objective and personal. We believe you should have a sound investment strategy, and that it should fit your situation and your goals. We believe lower risk for the same amount of expected return is better. That’s why we attempt to properly utilize all available global liquid asset classes, a strategy employed by sophisticated institutions for years. Within U.S. equities, our Smart Weighting™ approach improves on traditional indexing by maintaining more evenly weighted exposure to every sector and style. In hypothetical back tests, this methodology outperformed the S&P 500, and did so with lower volatility. Active stock picking and market timing hurt many more people than they help, so we are not searching for the next home run or jumping in and out of markets. Fees and taxes matter, so we attempt to minimize both. Who makes investment decisions and what role does my Advisor play? All assets are managed by our Investment Committee, with support from our research staff. Your Advisor ensures your money is managed in sync with your life and stated goals. Your Advisor is also responsible for communicating all aspects of our service to you in the method and frequency you desire. What are your fees? We have one simple fee based on a percentage of assets managed. Wealth management, trade costs and custody are included – you do not pay trade commissions. We bill monthly, in arrears, and routinely help clients with financial planning and 401(k) allocations at no charge. Our fee schedule is as follows: First $1 million: 0.89% For clients who invest $1 million or more: First $3 million: 0.79% Next $2 million: 0.69% Next $5 million: 0.59% Over $10 million: 0.49%

How do I get started?

Just follow these 4 simple steps: 1. Answer intake questions so we can evaluate your financial situation. 2. Your Advisor will look at any current investments and work with our Investment Team to develop your personal financial strategy. 3. If you decide we can help, we'll get accounts opened in your name at Pershing, a third-party custodian. These will be funded with cash or transfer securities. 4. We implement your new strategy. We’ll also monitor and rebalance your portfolio, and work hard to minimize your tax bill.