Employees define their financial health in complex ways. Here’s how employers can help.

Providing support for financial well-being is a vital part of helping employees thrive, especially since almost half of Americans say they aren’t financially healthy.

However, the emerging concept of financial wellness doesn’t have a universal meaning. In fact, 83% of respondents said there is no single definition for financial health because it varies from person to person, according to a recent financial well-being survey conducted by The Harris Poll on behalf of Personal Asset Retirement.

Despite this lack of clarity, employees are clear that financial wellness is an important goal — one that they’d like to achieve. Employers are in an important position to support their progress — and employees are receptive to their help.

In the following paper, we’ll share insights from our recent financial well-being survey, including:

- How Americans define financial well-being.

- The roadblocks that stand in their way.

- Their attitudes toward receiving support as they work toward financial well-being.

- How employers can support employees’ financial well-being.

Financial health roadblocks

Most Americans (60%) feel confident in their ability to achieve comprehensive financial health someday. But less than half say they’re financially healthy today. Their challenges are widespread: Almost seven in 10 (69%) experience at least one barrier on their path to financial wellness, and the average person faces two.

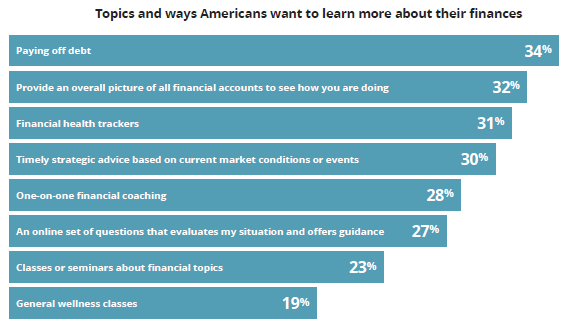

The good news, however, is that employees are eager to receive help in overcoming obstacles in the way of their financial wellness. The majority of Americans (70%) say learning more about financial health is a priority, and almost eight in 10 (78%) say they need help in optimizing their financial well-being.

Employers can help

While employees don’t want to go it alone, the financial wellness journey is still a personal one, and different employees will benefit from different kinds of support. Many employees are looking for straightforward and holistic advice as well as intuitive tools like financial trackers that make a daunting process easier.

Employers can support employees’ journeys to financial wellness by providing:

- Platforms that offer a baseline and multi-dimensional view of finances.

- Resources to guide employees toward their goals.

- An engaging, multi-platform experience for managing financial health.

- Personalized, jargon-free communications and engagement.

- Recognition that financial wellness is a journey.

In this landscape, employers can make a real difference in their employees’ overall well-being, including their mental health. Employers can help build on Americans’ enthusiasm by offering tools and resources that help employees understand their financial picture, prioritize goals and gather expert advice. Download the white paper to learn more.

Download research paper

RO1882454-1021