Inflation and other pressures are testing the finances — and confidence — of retirement plan participants. Plan sponsors have an opportunity to help.

This research brief explores the effect inflation and other pressures are having on retirement savers, as well as where these issues rank among other economic concerns. To accomplish this, Personal Asset collected responses from more than 2,000 Personal Asset retirement plan participants on a number of topics related to their personal financial health and outlook on the economy.

Financial health sentiment is unevenly distributed and declining

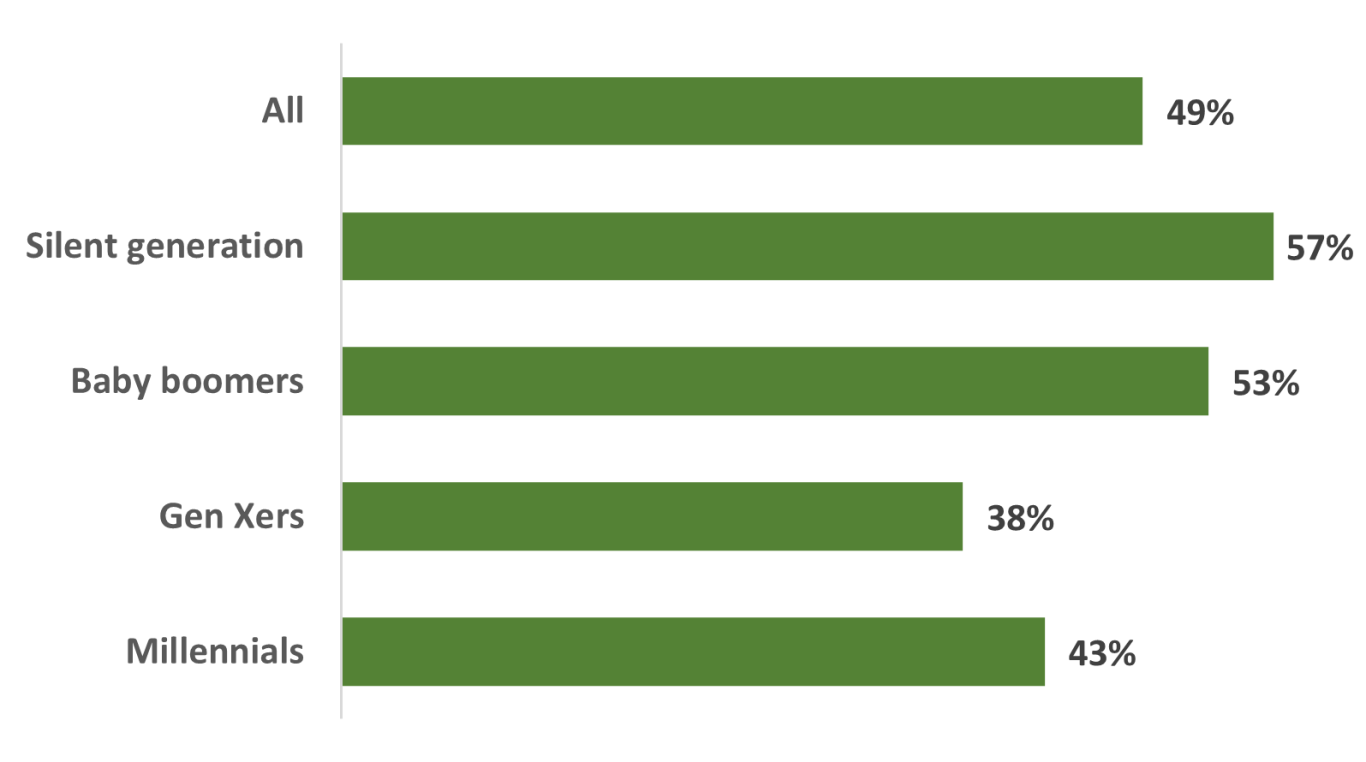

Nearly half (49%) of all participant respondents reported feeling financially healthy; only about 1 in 12 (8%) reported feeling financially unhealthy. However, feelings of financial health skew older, with most silent generation and baby boomer respondents feeling financially healthy, and fewer than half of Gen Xers and millennials feeling the same.

Feeling financially healthy by generation

On the whole, these feelings have deteriorated over the six months through April 2022. While 14% of respondents said their financial health is better than it was half a year ago, more than twice as many respondents said it was worse.

Participants are tightening the belt, but they can only do so much

The good news is that many plan participants are responding to the current economic environment with sound financial moves. Many have decided to create a budget and get in touch with a financial professional to better control their finances. Those who have decided to increase their retirement contributions (33%) far outnumber those who have decided to cut back (11%).

However, it appears that many are already stretched thin. Most respondents (57%) have decided to reduce their daily expenses. Half (50%) have delayed large purchases or are planning to, and nearly half (45%) have decided to switch to cheaper brands than they normally buy.

Economic uncertainty is taking a toll on respondents’ health and relationships

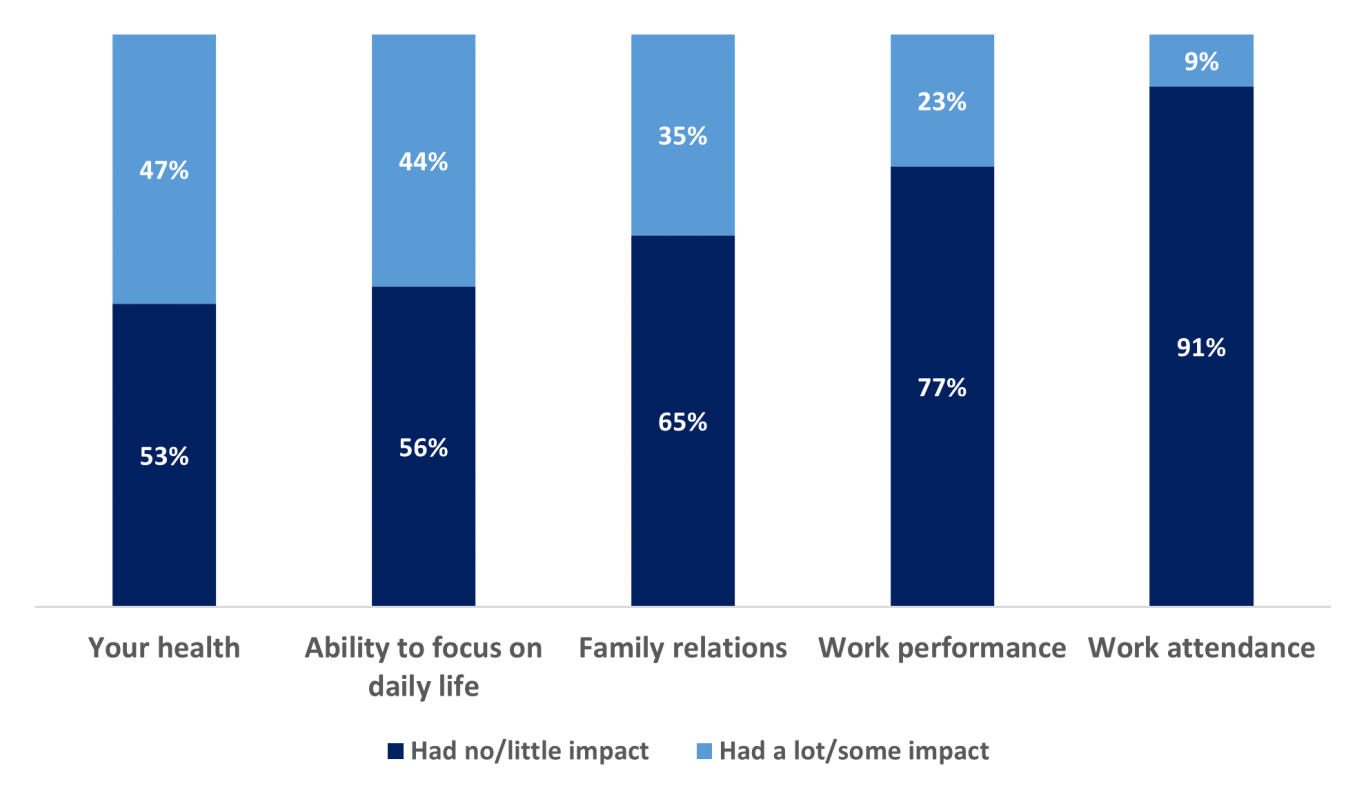

While economic uncertainty is ostensibly a threat to our finances, the stress it causes can harm several other aspects of our lives. The current economic environment is affecting participants’ family relationships, work, their ability to focus on daily life and their health.

Impact of being worried on participants

What you need to know to help employees

Economic uncertainty is affecting plan participants’ financial and mental health. While the effects are varied and nuanced, our research has produced several clear takeaways that employers can use to help employees navigate the current challenges:

- Inflation and other pressures affect employees differently.

- Employees may need education and advice to protect their finances and boost their confidence.

- COVID isn’t over for everybody.

- Employees’ financial worries affect their mental health.

For a more in-depth look at the research, data findings, and what plan sponsors can do to help, download the research brief.

And to learn more about how consumers overall are managing these challenging times visit Inflation and market volatility spur Americans to protect savings and seek advice.

RO2248942-0722