About the study

The pandemic and economic uncertainty have created significant challenges for the government sector and its employees. Given this environment, Personal Asset ing America’s Financial Journey (EAFJ) seeks to provide a comprehensive view of state and local government employees’ defined contribution (DC) savings behavior and retirement preparations. The study analyzes the behavior of approximately 1.55 million active state and local defined contribution participants with Personal Asset as the recordkeeper.

The study is structured across the following three themes:

- Savings and engagement

- Investing and planning behavior

- Improving outcomes

Below is a sampling of the study’s key findings.

Download the study to learn more.

Savings and engagement

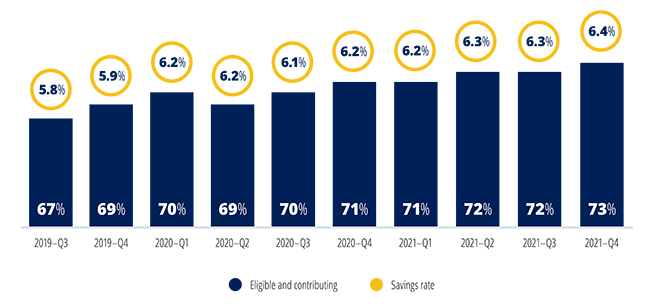

Government participants have remained resilient during the pandemic and uncertain economic conditions. They are saving an average of 6.4% of their salary in their workplace retirement plan, up from 5.9% two years ago. Not only are participants saving more, but a greater proportion of participants with a balance are also saving compared to the same time period.

Average quarterly savings rates by percentage of eligible contributing participants

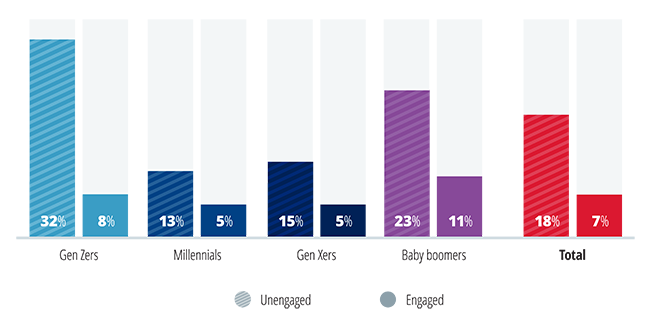

Intuitively, retirement plan engagement can lead to better outcomes through awareness, education, guidance and advice. This is especially true with engaged government workers who save at almost twice the rate of unengaged workers. Breaking down the engagement data, we find:

- The web is the preferred engagement channel.

- Female participants are less engaged than males, especially millennial and Gen X women.

- Male participants are twice as likely as females to use apps.

Investing

About half of government participants utilize professional management. That breaks down to one in six participants using a managed account and about one in three using a target date fund (TDF). Compared to TDF users, participants with managed accounts have both higher savings (6.4% vs. 5.1%) and engagement rates (60% vs. 42%).1

Overallocation to stable value could be detrimental to retirement readiness. More than one in 10 (13%) government participants are 100% invested in stable value options, with a higher proportion of participants concentrated with Gen Zers and baby boomers.

Participants who are 100% invested in stable value products by generation and engagement status

Improving outcomes

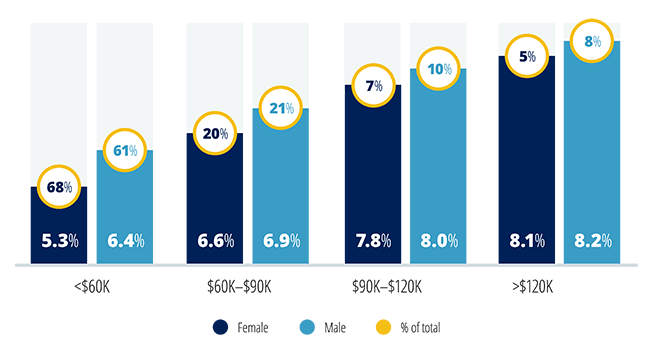

The gender retirement savings gap is more concentrated with lower income participants. Despite women having to plan for longer retirements and accounting for a majority of the government workforce, female government participants are saving 15% less than male government participants (6.0% vs. 6.9%). Their average account balances are also 70% of male government participants.

Savings rates and distribution of participants by gender and income

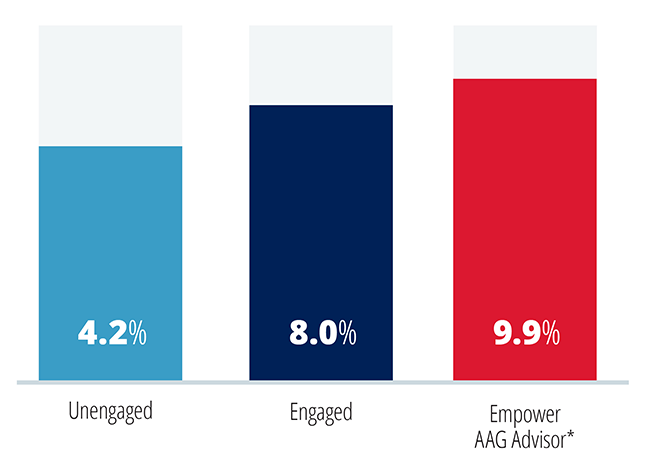

Engaged government workers have savings rates 90% higher than unengaged participants. Participants using Personal Asset ’s Advised Assets Group have even higher engagement rates. However, only 45% of eligible contributing participants are engaged.

Savings rates by type of interaction

Categories are mutually exclusive.

* Participants using advisors are serviced by Advised Assets Group (AAG) — registered investment adviser representatives. There is no guarantee provided by any party that participation in any of the advisory services will result in a profit.

Key takeaways

Although public sector DC plans are designed to supplement defined benefit plans, they play an important role in helping employees meet their retirement income needs. Early career DC plan engagement and savings can help put employees in a strong position to fill any retirement income gaps when they retire.

Download the study to learn more.

To also learn about the savings behavior and retirement preparations of workers in the for-profit DC market, click here.

Securities, when presented, are offered and/or distributed by Personal Asset Financial Services, Inc., Member FINRA/SIPC. EFSI is an affiliate of Personal Asset Retirement, LLC; Personal Asset Funds, Inc.; and registered investment adviser, Personal Asset Advisory Group, LLC. This material is for informational purposes only and is not intended to provide investment, legal or tax recommendations or advice.

Investing involves risk, including possible loss of principal. If discussed, past performance is not a guarantee of future results.

Asset allocation, diversification, dollar-cost averaging and/or rebalancing do not ensure a profit or protect against loss.

Risks associated with investment options can vary significantly, and the relative risks of investment categories may change under certain economic conditions.

Personal Asset and its affiliates are not providing impartial investment advice in a fiduciary capacity to the plan with respect to this material. The plan fiduciaries are solely responsible for the selection and monitoring of the plan’s investment options and for determining the reasonableness of all plan fees and expenses.

Personal Asset may receive revenue-sharing-type payments in relation to third-party investment options and affiliated investment options, Personal Asset Funds and Putnam Funds. Please contact your Personal Asset representative for more information.

There is no guarantee provided by any party that participation in any of the advisory services will result in a profit.

“EMPOWER” and all associated logos, and product names are trademarks of Personal Asset Annuity Insurance Company of America..

The research, views and opinions contained in these materials are intended to be educational; may not be suitable for all investors; and are not tax, legal, accounting or investment advice.

Android logo is a trademarks of Google LLC.

iOS is a registered trademark of Cisco in the U.S. and other countries and is used under license.

©2022 Personal Asset Retirement, LLC. All rights reserved. WF-1769550 RO2178298

eb4d.jpg?itok=dx1eYSwP)