Inflation and market volatility spur Americans to protect savings and seek advice.

For more than a decade, American investment portfolios and retirement accounts have benefited from accommodative monetary policies and a powerful economy. But now, in the wake of skyrocketing inflation and prolonged stock market volatility, Americans are watching their investment account balances shrink while also facing rapid increases in their cost of living.

As they contend with worries about a potential recession, how are Americans feeling and behaving in response?

According to a new survey conducted by The Harris Poll on behalf of Personal Asset and Personal Capital, Americans’ economic confidence has taken a hit. The vast majority (85%) of survey respondents are concerned about inflation, and almost three-quarters (73%) say they have taken action to prepare for a potential recession.

The research brief provides insight into the following trends revealed by survey data:

Mood: Confidence decreases and future optimism wanes.

- More than a third (38%) of Americans feel very or somewhat financially unhealthy — a significant jump from the 22% measured in the first quarter of 2021.

- Americans are anxious for a stronger financial buffer against adversity — the average savings nest egg they need to feel secure grew 17% over the past six months, from $441,178 to $529,993.

Behavior: Americans prioritize retirement savings, but some pull back on investments.

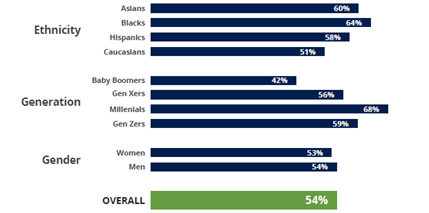

- Americans are generally holding steady when it comes to retirement. Most respondents (58%) have not cut back on their retirement contributions and are not considering doing so. And almost the same proportion (54%) have begun contributing more or are planning to do so soon.

- Confronted with rising inflation, almost half of Americans (49%) plan to make or have already made changes to their investment approach.

- Six in 10 (61%) Americans have not sold their assets or investments and are not planning to do so.

Need: Employees are hungry for support with financial.

- Almost half (46%) say they don’t know how best to invest their money.

- More Americans are now looking for financial support — 53% have already spoken to a financial professional or plan to do so within six months. Most Americans also wish they had sought financial advice earlier.

Widespread agreement: Most wish they would have obtained financial advice earlier

I wish I would have gotten financial advice earlier.

Takeaways: How to help.

There’s a significant opportunity for employers to step in and help participants stay the course with their retirement and investment portfolios. Four actions employers can take:

- Build awareness about professional advice services and encourage their use.

- Communicate about the importance of staying the course.

- Adapt messaging for groups that are more likely to take drastic actions.

- Educate about economic conditions.

For a more in-depth look at the research, data findings, and what plan sponsors can do to help, download the research brief.

RO2251023-0722