How Americans are preparing for their financial futures

About the study

The past 12 months were supposed to bring a return to normalcy from a pandemic that upended Americans’ lives. Instead, the impacts of global conflict, historic inflation and market volatility have taken center stage. With this backdrop in mind, Personal Asset ’s second annual Empowering America’s Financial Journey provides a window into how Americans are faring with their retirement and financial planning.

The study analyzes the behavior of 4.3 million active corporate defined contribution (DC) participants to better understand their savings habits and levels of involvement with retirement planning. A separate representative survey of more than 2,500 Americans takes a qualitative look at Americans’ savings situation to evaluate their attitudes and confidence related to retirement planning.

Download the study to learn more

Changing priorities amidst financial challenges

Inflationary pressure and sharp market declines are taking a toll on retirement savers as they are forced to prioritize short-term financial challenges over longer-term goals. Significant findings include:

- The portion of Americans who say retirement is a top financial goal dropped from

67% to 53%.

- Making ends meet is now a top financial goal for 26% of Americans with a

retirement plan.

- Fewer Americans are prioritizing building an emergency savings fund or saving for a major expense.

- More than nine in 10 survey respondents consider inflation a top concern.

These pressures have caused the majority of Americans to take action to counter the effects of inflation on their personal finances. These actions include:

- Cutting back on daily expenses (50% have done this; 28% plan to do this).

- Creating a budget (47% have done this; 33% plan to do this).

- Delaying large purchases (41% have done this; 31% plan to do this).

- Seeking alternate income streams (34% have done this; 37% plan to do this).

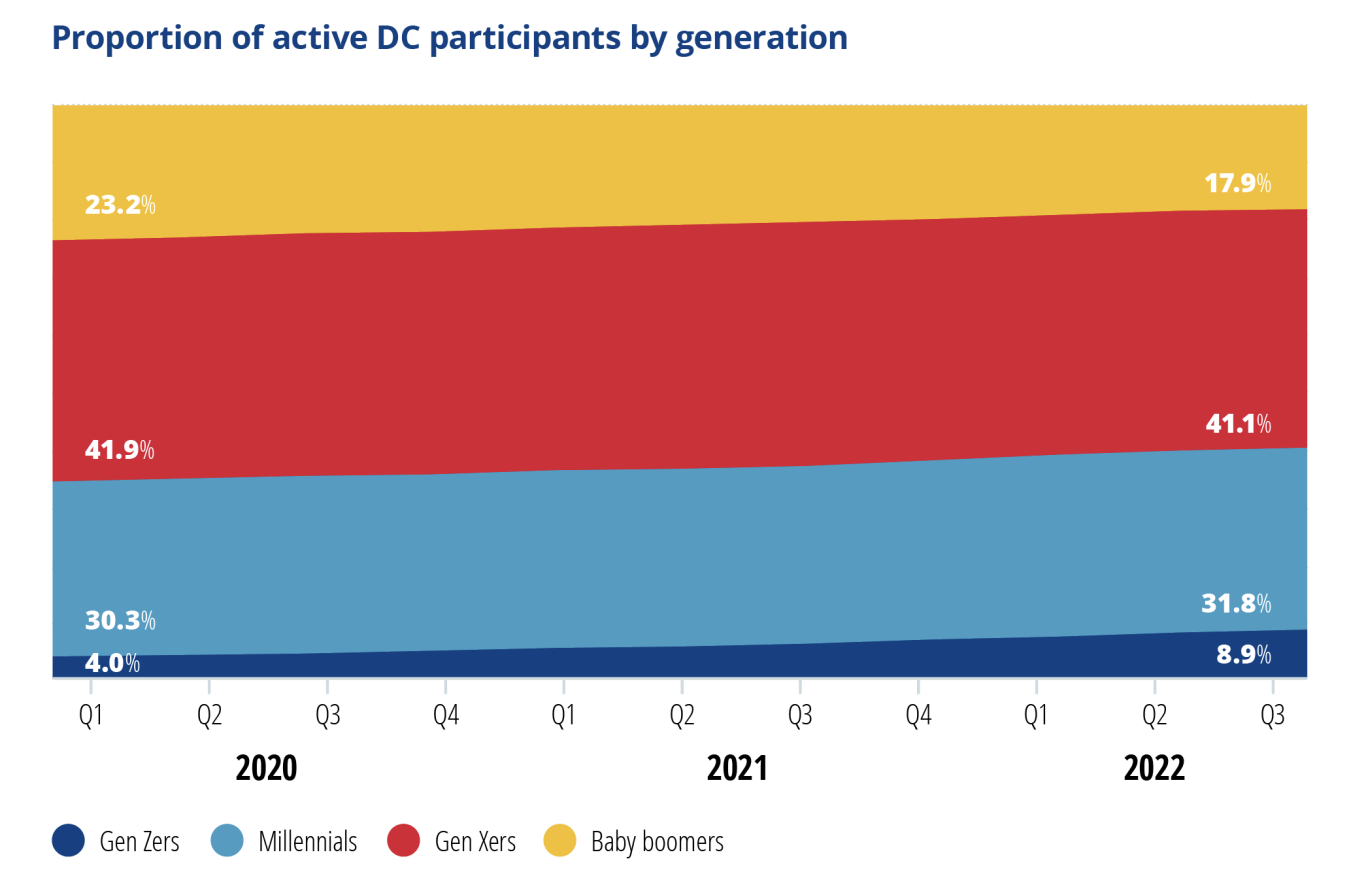

Shifting demographics

Changing demographics and the rise of Gen Z are reshaping the DC landscape. Baby boomer retirements are in full swing, and the oldest Gen Xers are rapidly approaching retirement. The proportion of millennials in DC plans has increased slightly, but the real growth is coming from Gen Z. Breaking down the data, we find:

- Gen Zers as a percent of Personal Asset active participants more than doubled between the first quarter of 2020 and the third quarter of 2022. This trend is only anticipated to accelerate, as Gen Zers are expected to account for 30% of the workforce by 2030.1

- Gen Z has lower savings rates than older generations, overall lower account balances and are typically auto enrolled in their plans.

- Gen Z participants accounted for nearly 40% of total active new hires, followed by millennials, who represented a third.

- Gen Zers also led the way in the share of terminated participants, accounting for 37% of total terminations.

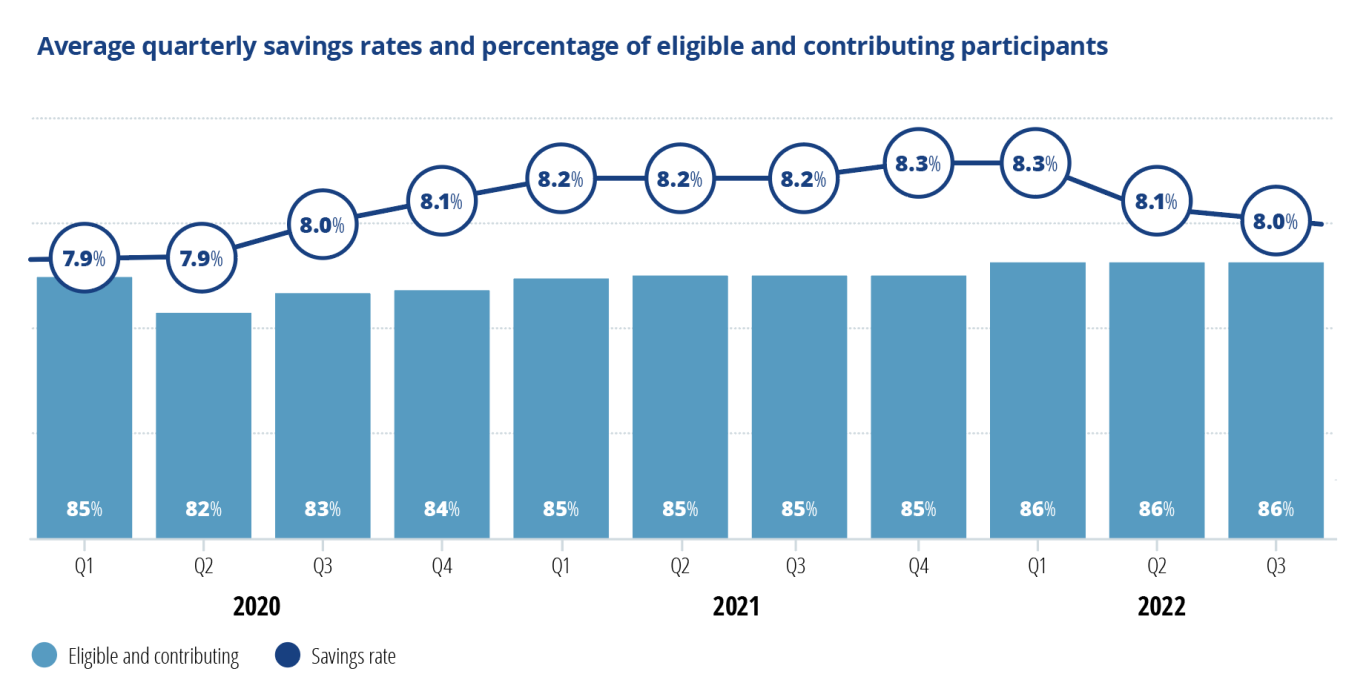

Savings rates and confidence

While average savings rates inched downward this year, the percentage of contributing participants increased. Despite the small savings rate decline, participants’ resilience is on display when considering the rapid rise in inflation and sharp market declines of 2022. As we look at savings habits, we find:

- Participant savings rates decreased slightly, down 0.2% over the past 12 months.

- The number of participants taking out loans increased by 13% over the past 12 months.

- Hardship withdrawals jumped by 24% in the past year.

- Average account balances have declined by approximately 27%.

Confidence in retirement savings is down in 2022: The percentage of participants who feel confident they are saving enough has declined to 52%, compared to 58% last year. The downward trend is shared across generations except for Gen Zers, who reported an increase in confidence (63% vs. 60%). According to respondents, factors limiting their savings rates include needing to make ends meet, focusing on paying off debt and concerns about market volatility.

Download the study to learn more

Engagement

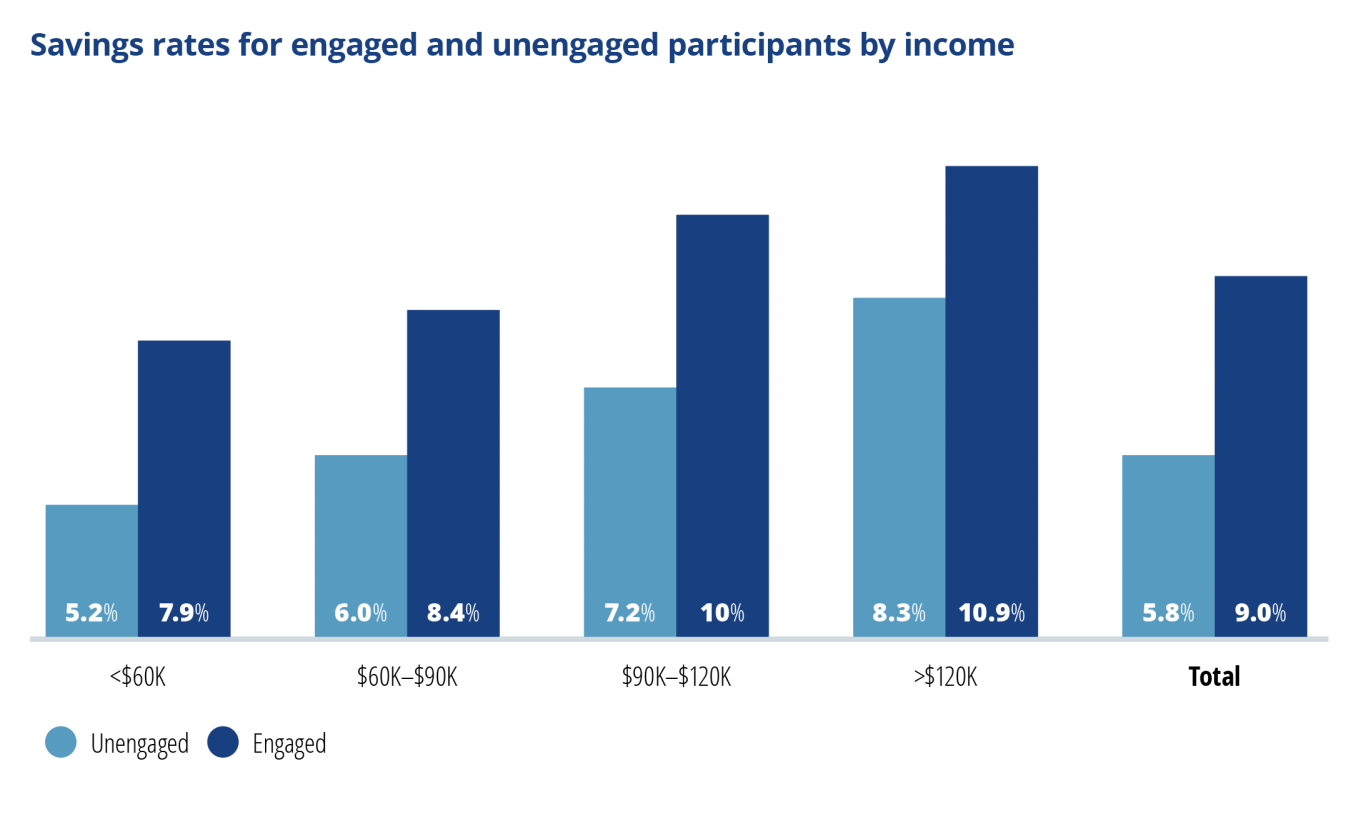

Getting people engaged in their retirement planning is a key component of driving better outcomes. We define engagement as any interaction with our website, app or Customer Care Center or with an Personal Asset advisor over the last 12 months.

The total engagement rate has modestly declined over the past year. Participant engagement levels may fluctuate based on several factors. Diving deeper into engagement trends, we observe:

- Engaged participant savings rates are 56% higher than rates for unengaged participants.

- Nearly 30% of participants aren’t maximizing their employer’s match. That percentage jumps to 48% for unengaged participants.

- Savings rates for engaged and contributing participants with eligibility of less than one year are 73% higher than for unengaged participants.

Financial advice and guidance

Fewer workers with a retirement plan feel comfortable making investment decisions than a year ago, down to 40%. With growing discomfort in making investment decisions, many Americans seek external advice and guidance. Working with advisors helps increase confidence, and those who consult one are more likely to feel assured in their investment decisions and their retirement readiness. We find:

- A combination or hybrid approach comprising advice from online sources and from a financial professional (43%) is the preferred way to receive advice.

- Baby boomers have a higher preference for engaging with a financial professional than do Gen Xers and millennials.

- Millennials are the most likely to prefer online advice (31%).

- Managed account users have higher savings rates (22% higher) than participants invested in target date funds (TDFs).

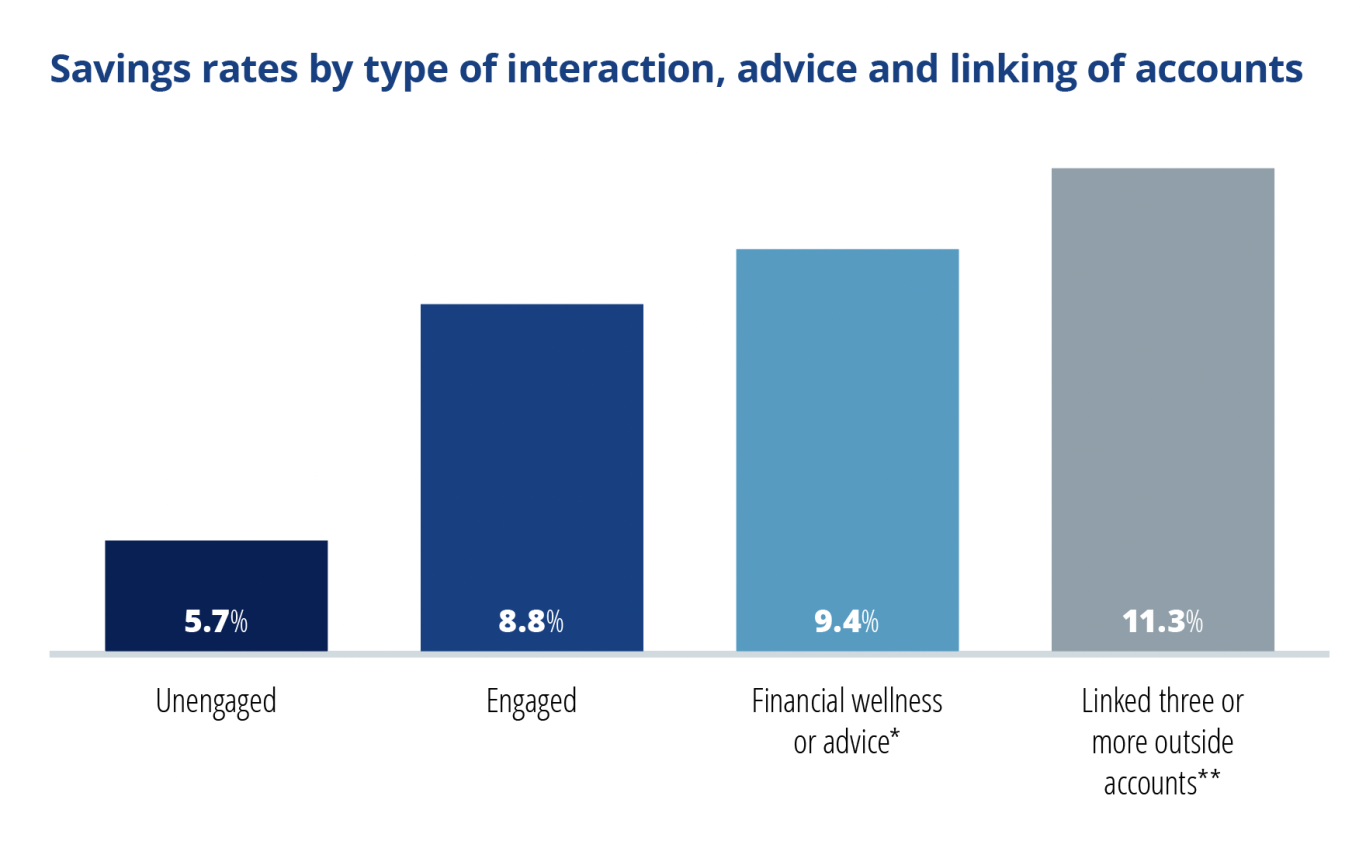

People who are engaged and leverage educational content, seek out advice or guidance, or link or consolidate external accounts to create a comprehensive financial view have higher savings rates than people who are not engaged.

*Financial wellness refers to website visits of pages focused on financial wellness topics. Advice includes managed accounts.

**Linking of accounts provides participants with a consolidated or comprehensive view of their financial situation.

Helping Americans move forward along their financial journey

This study provides insights into Americans’ financial and retirement savings habits during a time of financial uncertainty. With these findings in mind, these three tips can help position Americans to better prepare for financial readiness in retirement.

Itʼs about the basics: Save early and often. Maximize savings opportunities, take full advantage of an employer match and save consistently.

Focus on the present for a more secure tomorrow. Create a budget and financial plan to manage your everyday expenses to be able to focus on longer-term goals.

Seek out professional advice. Advice can benefit all people regardless of their household income or account balance. A workplace retirement plan is a great place to start.

Download the study to learn more

RO2578591-1122